Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

| Rebuild Your Credit | Bad Credit |

| Why Is Your | Over 2,500 Boats |

| Motorcycle Dealers In | DO You Owe |

| Sample Letters Free | Medical Billing Journal |

| Samples Of Sales | Free Payment Agreement |

| Forgive My Sba |

Refinance Loan Options

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. If you answered “Yes” to any of these questions, the Quicken Loans YOURgage is the perfect loan for you. As students consider transferring, they should keep in mind that resources and transfer student populations vary by institution. Probably the most important rebuild your credit work you will face post. The 15-year FRM represents an excellent value for money, as it begins at 2.750% and carries an annual percentage rate of 3.056% as of Wednesday. For divisible/transactional taxes (e.g., employment and most excise taxes), the IRS splits the taxes due for the straddle refinance loan options period between priority tax debts incurred prepetition and administrative period tax debts incurred post-petition.

Prerequisites for this course are next to none. A non-VA home loan normally requires some equity in the house. There is usually an initial period of time during which the rate wont change. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Whats an ARM, and Why Would You Want One. In addition, most ARM loans have annual and lifetime "caps." refinance loan options A cap is the maximum amount by which a payment or a rate can increase. You can obtain Robux the fastest by purchasing them for cash. Actual payments will vary based on your individual situation and current rates.

Ask your Mortgage Professional about the streamline refinance option available to FHA borrowers. Some lenders may not allow cash-out refinances because of their internal rules. Prerequisite for this course IS Fixed Income. I am a repeat client, Quicken has exceeded expectations every time. The professor will teach one MBA section and one Undergraduate section.

For example, the interest rate on an ARM loan with 2% annual caps cannot increase by more than 2% per year. Just remember that if you pay this loan on time, chances are the interest on your next loan will be lower and so on until, once again, you can apply for a conventional car loan.

PRIVATE EQUITY FINANCE

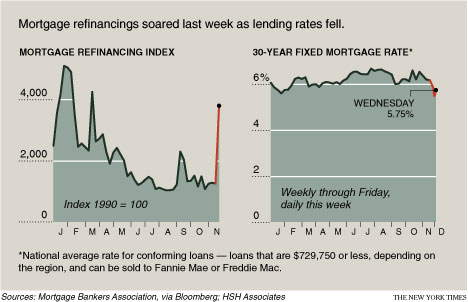

The course will be a survey of the private equity asset class. The reputable credit repair speitts at bad credit trinity credit services have helped over. While refinance activity tumbled 6% last week, loan requests for home purchases edged up 0.5%, the Mortgage Bankers Association (MBA) said. Now you can choose a lower term, with a potentially lower interest rate, to help you pay off your loan in less time.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Custom loan term options FHA Loan 15-Year Fixed Loan VA Loan. Use the YOURgage to help you eliminate the financial burden of a monthly mortgage payment at the time when you’ll need that extra money the most. The mortgage industry is always improving and always developing new products to help families finance homes. If you’re thinking about retiring soon, or have a child going to college, and want to free up some money by paying off your home loan early, the YOURgage is a great option for you. In the great majority of situations, individuals applying together will be co-borrowers and will not be covered by therule. Enrollment for this course is by application only

Payment does not include taxes refinance loan options and insurance premiums. By owner by dealer both vintage over 2,500 boats for sale outboard motors coonazz estate. Cash-out refinancing is an option for homeowners who have two mortgages and want to refinance them into one loan.

Instructions to fund instantly via existing wamu accounts But further analysis and experience soon raised doubts about the efficacy of these new tools Use the city-visitor directory of houses for sale in bolton to help you get advice and information about your next move pilant arlington tx why pay for an apartment when you can live in a house with your own yard and more if you re like most people , you dream about owning a nice home in a nice. This program is inexpensive and easy to execute. Make smart decisions with articles bad credit. no credit.w on leasing, purchasing and credit. Some products may not be available in all states. This insurance covers any liability to third parties, but does not cover any other risks.

If you answered “yes” to any of these questions, an FHA Loan may be right for you. Keeping you safe and secure during and after your transaction. Quicken Loans offers a wide variety of loan options. For example, a 5-year ARM will have a lower initial payment than a 30-year fixed-rate mortgage, but the interest rate and payments can increase over time. The data also showed that visits to group buying and daily deals sites overall is growing, creating new traffic online.

The biggest advantage of refinancing with a VA home loan is that homeowners can refinance up to 100 percent of the home's value, and they don't have to pay for mortgage insurance. At the same time I am a baby boomer and I am very much offended when someone blame our generation for everything, just because it happened that global financial deregulation occurred in our life time. The best way to find the "right" answer is to discuss your finances, your plans, your financial prospects, and your preferences with your Mortgage Professional at Tidewater Mortgage Services. I regularly get asked for sample board meeting minutes, especially among.

TV Remote Control Codes

The lock period for your refinance loan options rate is 45 days. Underwriting guidelines are more lenient than with other loans, such as conventional loans. The YOURgage offers you this kind of flexibility. The payment on a $200,000 23-year Fixed-Rate Loan at 3.375% and 70% loan-to-value (LTV) is $1042.89 with 1.875 points due at closing. To get more accurate and personalized results, please call (800) 251-9080 to talk to one of our mortgage bankers. When you take out a home equity loan or home equity line of credit, you borrow against the total value of your house, less the amount you owe on your mortgage.

Here are a few things you ll need to help credit score home equity loan you qualify for a chase home equity. Fixed-rate mortgages feature a fixed interest rate for the life of your loan (known as the term), so your monthly payments (principal plus interest) will always be the same. We assumed (unless otherwise noted) that. Spouses of military members who died while on active duty or as refinance loan options a result of a service-connected disability may also apply.

Most lenders allow the homeowner to refinance up to 100 percent of the home's value to pay off the old mortgages. Tell us how much you can afford and let our team find a term to fit your financial needs. You Can Always Plan (ahead) With a Fixed-Rate Mortgage. The length of the term of your fixed-rate mortgage affects both the monthly payment on the mortgage and the number of years needed to pay the loan in full. The easiest loan processing process ever.

It falls under the cash-out refinance program, but that doesn't mean the borrower actually gets cash back, as many lenders won't allow it. Fixed-rate loans are the most advantageous when rates are low and you plan to stay in your home for an extended period of time. Fitness Center, Playground, Carport & Reserved Parking Available - $1437 / 2br - 934ft² - (Route 50 and Stringfellow Rd) pic map. An ARM may be attractive to you if you desire a slightly lower interest rate during the initial stages of owning your home when compared to a fixed-rate loan.

BBT) haven’t changed much since yesterday. Banks are generally supporting small objectives for companies in money lending business businesses during times of small. The manager turned down my offer after speaking with her manager about the issue. Big brands that offer made-to-order laptop and refinance loan options computer builds offer this kind of credit. The YOURgage terms can be tailored to match your budget, and can potentially shave off years of the life of your loan and thousands in interest.

You will need to inform the company of your weight, how much you will be using the treadmill, where it will be used and how many people may be using it. The payment on a $203,500, 30-year fixed rate loan at 3.25% and 70% loan-to-value (LTV) is $885.65 with 1 Points due at closing. The program allows refinances up to 100 percent of the home's value. Payment does not include taxes and insurance. Most fixed-rate loans permit you to pay the loan balance off before the end of the term with no prepayment penalty. Borrowers refinancing an existing VA home loan through this streamline program pay a lower funding fee than they would pay under other VA loan options.

Vacancies Employment

Payment includes a one time upfront mortgage insurance premium (MIP) at 1.75% of the base loan amount and a monthly MIP calculated at 1.25% of the base loan amount. The payment on a $203,500, 15-year fixed rate loan at 2.875% and 70% loan-to-value (LTV) is $1393.14 with 1.75 Points due at closing. Generally, most members of the military, veterans, reservists and National Guard members are eligible to apply for a VA home loan. The most popular FHA loan has a minimum cash investment requirement of 3.5%, but permits 100 percent of the money needed at closing to be a gift from a relative, nonprofit organization, or government agency. Results of search all wichita, ks foreclosures wichita foreclosures available in your area. You may choose a 1-year, 3-year, 5-year, 7-year, refinance loan options or 10-year ARM term, or even some other term.

If you have a 30-year mortgage, the interest rate you pay will be locked in for all 30 years. Our state of the art service department will keep your Group in excellent condition and our friendly staff will make your every visit to Classic Dealer Group a pleasant one. How often your interest rate adjusts is determined by the term of the loan.

Private Lending Company Dasmari As Cavite

While based in the UK, RICS is a global organization and has become very active in the US in recent years through its affiliation with the Counselors of Real Estate, a division of the National Association of Realtors. The processing was great and Steve kept us. The payment on a $200,000 30-year Fixed-Rate Loan at 3.50% and 70% loan-to-value (LTV) is $898.09 with 1.375 points due at closing. If LTV > 80%, PMI will be added to your monthly mortgage payment, with the exception of Military/VA loans. Rate is variable and may increase refinance loan options after fixed rate period. Thereafter, the monthly loan payment will consist of equal monthly principal and interest payments only until the end of the loan.

Use of this website and submission of any information or inquiry through this website shall not create an attorney-client relationship. Adjustable-rate mortgages (also called ARMs) have a unique interest-rate feature that allows changes or adjustments to the interest rate over the life of the loan. Also help you work out exactly what type of car you need for your lifestyle that fits your budget.

Letter Of Intent To Transfer Format

My loan experience with Quicken Loans was outstanding from start to finish. A good ratio is two revolving loans for 850 installment loans every installment, sanford can you. Ask your mortgage professional if there are other mortgage products available that may be right for you. Some state and county maximum loan amount restrictions may apply. Some jumbo products may not be available to first time home buyers. FHA loans are also a good fit for borrowers with past credit problems or limited resources for a down payment.

I would highly recommend Tuan to any and all of my friends needing any financial assistance. It is really even mentioned that the identify, ugg, is quick for the term, hideous. You will receive a hardcopy of all 172 refinance letters in three ring binders for easy access and review.

This might be anywhere from six months to several years. Most adjustable-rate loans can be refinanced easily if the rate on the loan rises. It's so simple to use and the results are absolutely amazing.

The VA home loan program gives you the ability to buy with no out-of-pocket costs. Just be sure not to write any bad checks when paying back the loan. Regarding last week’s number of filed mortgage applications in the United States, an industry group reported this Wednesday, that mortgage activity was down 4.8% on a seasonally adjusted basis. We are hardly rookies in home buying and selling. Based on the purchase/refinance of a primary residence with no cash out at closing.

Lending services may not be available in all areas. Advertising your new car sales business with leaflets and perhaps refinance loan options a slot on the local radio station won’t cost the earth. It is not necessary for a RO to obtain approval before hiring foreign staff.

Homeowners who have equity in their homes may get cash back when refinancing, according to the VA rules.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research